- Print

Tax Rates

- Print

Tax Rates

Tax rates are percentages of paid sums that are calculated as tax. Tax rates can vary by jurisdiction such as nation, state, or city, and can also differ by the type of product being sold. They may be combined or excluded.

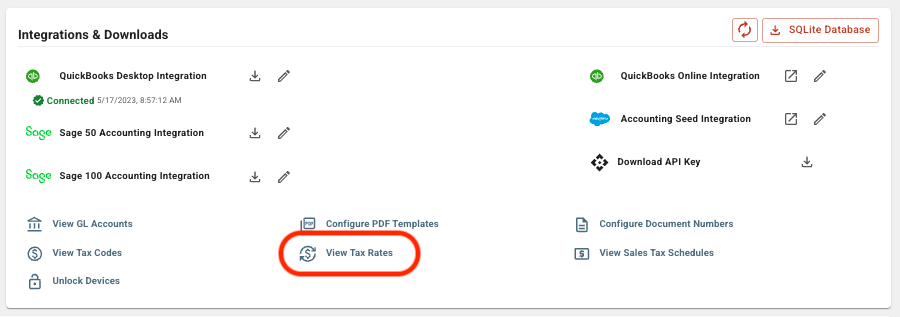

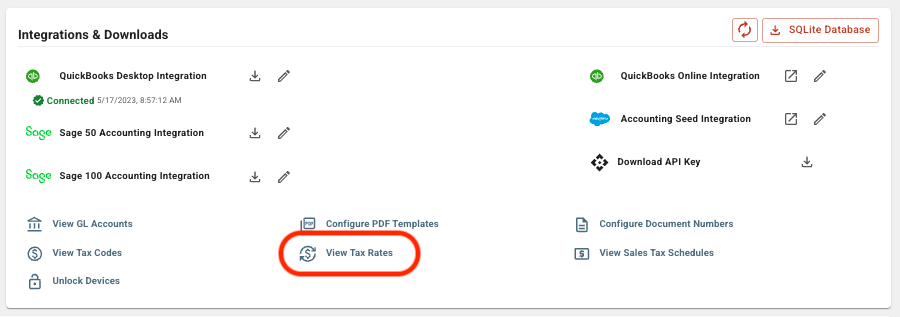

To reach your list of Tax Rates in Steelhead:

- Open the Domain tile.

- Click the 'View Tax Rates' button found in the Integrations & Downloads section.

Tax Rates Table

Tax Rate information is imported to Steelhead from your integrated accounting software. Otherwise, the information is manually entered with the 'New Tax Rate' button.

The Tax Rates table can be searched, ordered, and paged.

Each row of the table displays:

- Name - Linked to more details about the tax rate

- Related Tax Code, if any

- Related GL Account, if any

- Archived At - date the tax rate was archived, if any

- Related Vendor, if any

- Related Sales Taxes

- Description

- Rate - the percentage of an amount that is taxed

- Actions

- View integration history

- Update tax rate from integration

- Archive/unarchive

- Edit (if tax code was manually added)

Tax Rate Set Up

A tax rate may be set up like this:

Tax rate jurisdiction, with associated legal tax rate percentage

Tax exempt, 0% tax rate

Tax rates are connected to Sales Tax, which are then applied to invoices and purchase orders. A rate may need to be calculated especially for organizations which are exempt from certain taxes and liable for others.

--