- Print

Tax Codes

- Print

Tax Codes

Tax codes are legal requirements for taxation. They are a system of numbers, letters, or identifiers used to categorize taxes. They determine whether something is taxable or not.

To reach your list of Tax Codes in Steelhead:

- Open the Domain tile.

- Click the 'View Tax Codes' button found in the Integrations & Downloads section.

Tax Codes Table

Tax Code information is brought over to Steelhead from your integrated accounting software. Otherwise, the information is manually entered with the 'New Tax Code' button.

The Tax Codes table can be searched, ordered, and paged.

Each row of the table displays:

- Name - Linked to more details about tax code

- Sales Tax Override

- is Taxable - determines whether taxes apply or not

- Archived At - date the tax code was archived

- Description

- UUID - Unique identifier that comes from accounting integration

- Actions

- View integration history

- Update tax code from integration

- Archive/unarchive

- Hide/show tax code as an option

- Edit (if tax code was manually added)

To make edits to Tax Codes that are connected to an integrated accounting software, they must be made in the accounting software and then updated in Steelhead.

Tax Code Set Up

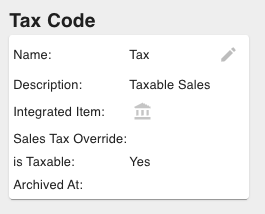

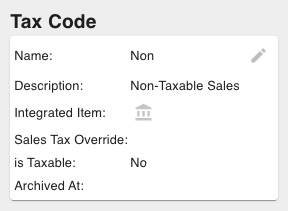

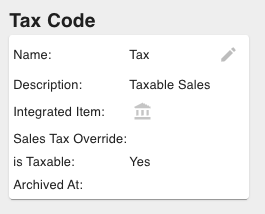

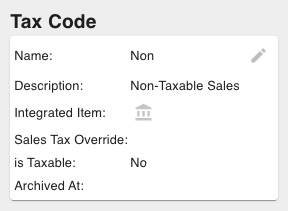

A tax code may be set up like this:

- Tax (taxable sales)

- Non (non-taxable sales)

Default Tax Code

If you want a tax code to be automatically set on line items, use the Domain Setting 'Default Tax Code' to determine the default tax code. You may change the tax code that is set automatically on line items.

A tax code can also be set on individual Vendors. When the vendor is selected on a Purchase Order, the tax code will automatically populate for each line item. Vendor default tax code will override the default tax code set in domain settings.

Details of Use

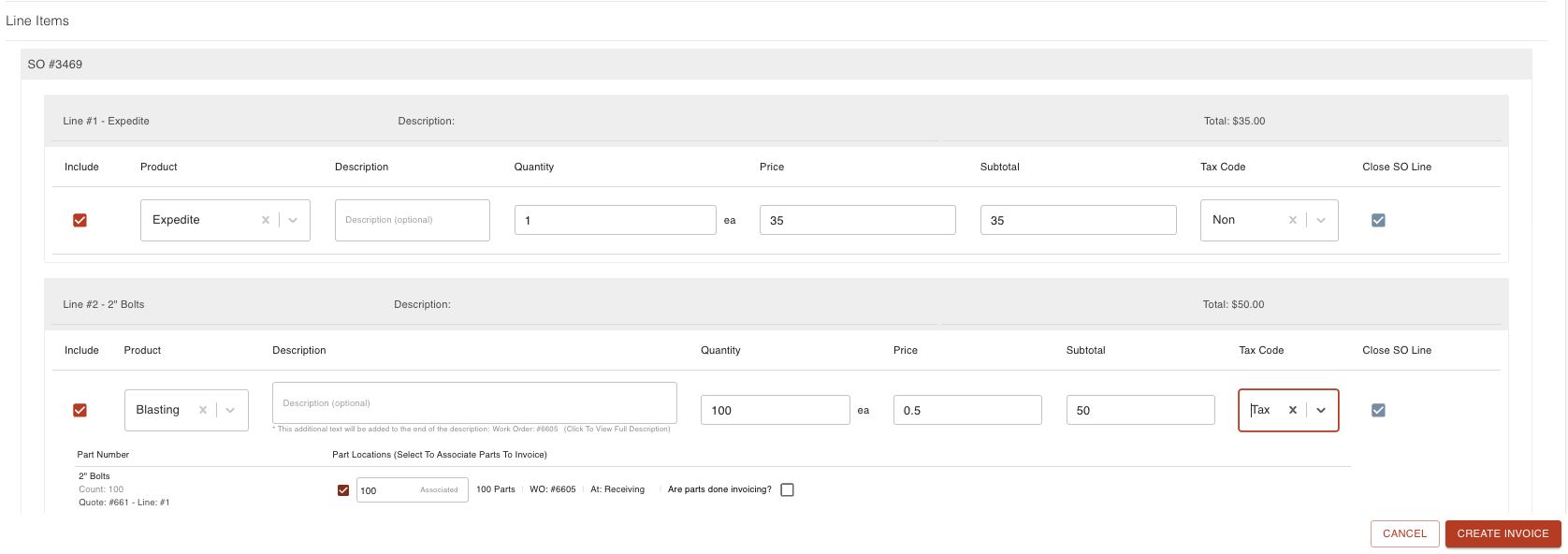

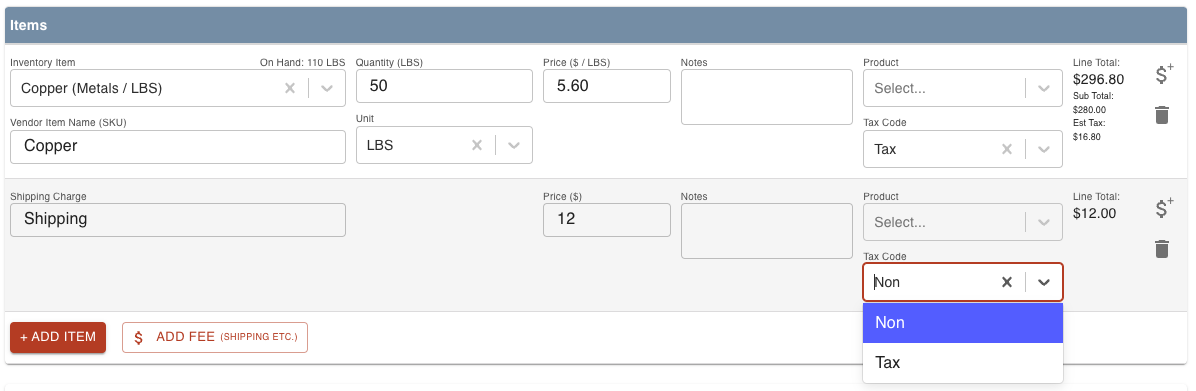

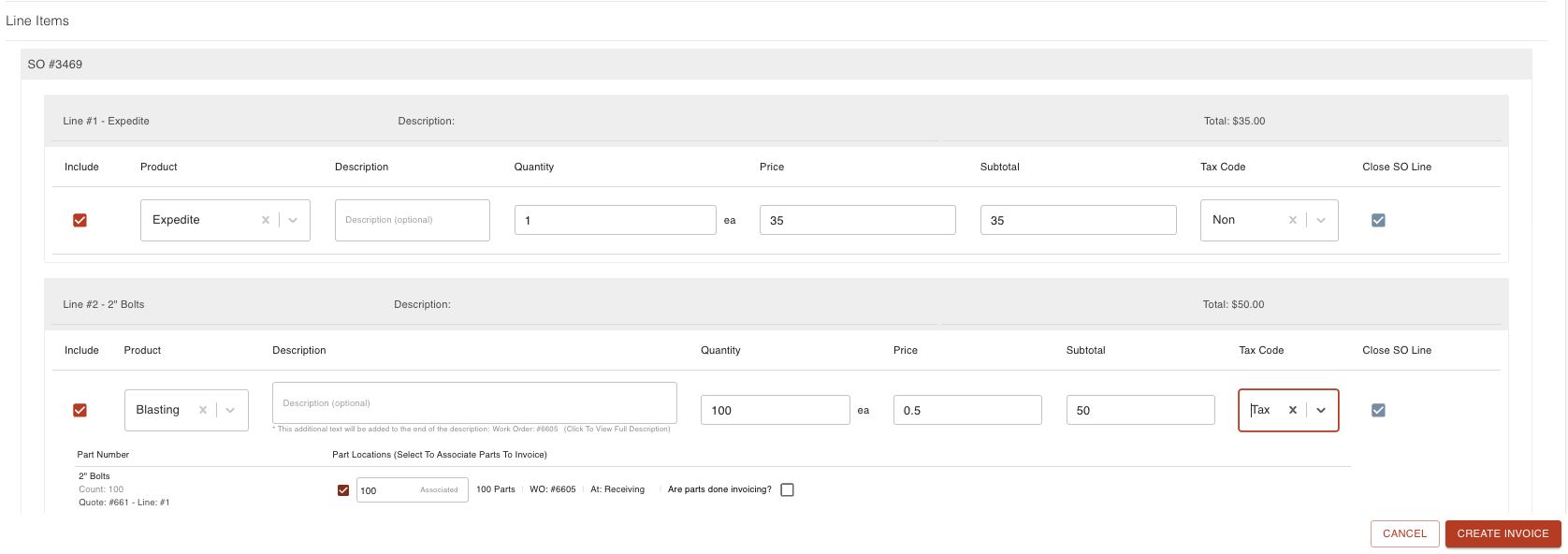

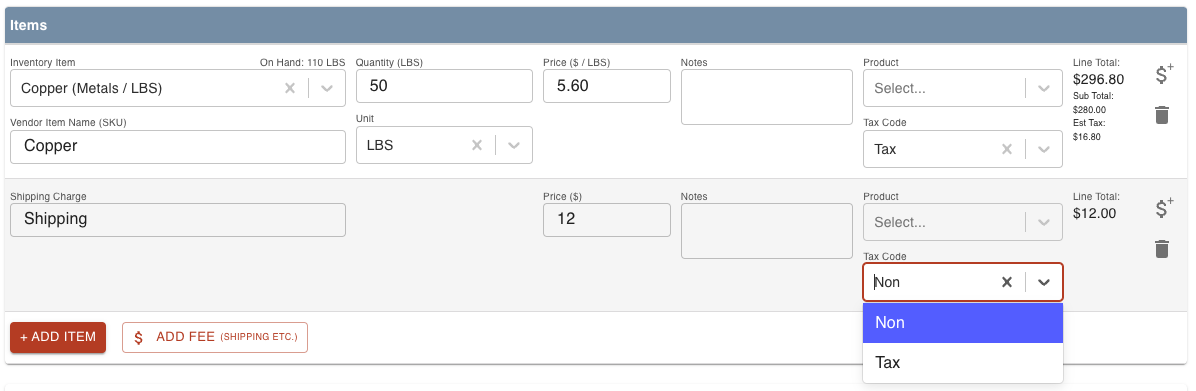

Tax Codes are used at invoicing and purchase order creation. Set the tax code on each line item to determine whether the line is taxed or not. Sales Tax also plays a role in whether line items are taxed or not.

Invoice

Purchase Order

An empty line item tax code is considered non-taxable. This may change when exported to integrated accounting software, depending how it is set up.

--